- +27 41 582 5150

- joanne@anthonyinc.co.za

- Mon-Thur 8:00am - 4:30pm | Fri 8:00am - 4:00pm

Marriage and Divorce

Section 37D(1)(d) of the Pension Funds Act previously permitted for deductions (in terms of a divorce order as contemplated in section 7(8) of the Divorce Act) to be made from the member’s benefit or minimum individual reserve.

The section was recently amended by the Financial Services Laws General Amendment Act. As of 28 February 2014, Section 37D(1)(d) of the Pension Funds Act states that a registered fund may:

"deduct from a member’s or deferred pensioner’s benefit, member’s interest or minimum individual reserve, or the capital value of a pensioner’s pension after retirement, as the case may be – ”

What is the effect of the amendment?

The effect is that the deductions in section 37D in respect of maintenance and divorce orders as well as income tax have been extended to the "member’s interest and capital value of a pensioner’s pension after retirement”.

The question now really is whether "capital value of a pensioner’s pension after retirement" includes annuities purchased post-retirement, like an Investment-Linked Living Annuity (ILLA). If so, does this mean a non-member spouse may now claim from such annuities as part of a divorce order? The answer is no if regard is had to the below:

1. Pension Funds Act 24 of 1956

As a general rule a fund may only make a deduction from a member’s benefit if such a deduction is permitted in terms of the Pension Funds Act, the Income Tax Act and the Maintenance Act. This general rule however has exceptions as set out in section 37D.

Section 37D(1)(d)(i) now reads that a registered fund may deduct from "a member’s or deferred pensioner’s benefit, member’s interest or minimum individual reserve, or the capital value of a pensioner’s pension after retirement as the case may be) any amount assigned from such benefit or individual reserve to a non-member spouse in terms of a decree granted under section 7 (8) (a) of the Divorce Act, 1979 (Act No. 70 of 1979)”.

The key terms (underlined above) are defined in the Pension Funds Act as follows:

• "Deferred pensioner” is defined as a member who has not yet retired but left the service of the employer concerned prior to normal retirement date leaving in the fund the member’s rights to such benefits as may be defined in the rules.

• "Member” is defined as meaning, in relation to --

- a fund referred to in paragraph (a) of the definition of "pension fund organisation”, any member or former member of the association by which such fund has been established;

- a fund referred to in paragraph (b) of that definition, a person who belongs or belonged to a class of persons for whose benefit that fund has been established,

(a) but does not include any such member or former member or person who has received all the benefits which may be due to him from the fund and whose membership has thereafter been terminated in accordance with the rules of the fund;

• "Pensioner” is defined as meaning a person who is in receipt of a pension paid from the fund.

Once a member retires and purchases a member owned annuity, he is no longer a member of the fund – he has effectively received all the benefits which may be due to him from the fund and his membership will thereafter be terminated in accordance with the rules of the fund.

Moreover, the words "the capital value of a pensioner’s pension after retirement” explicitly refers to "pensioner”, which in turn refers to the fund.

Even if you argue that this aims to include a pension paid by the fund (i.e. a fund owned annuity), where the fund still has commitments to the member, it would still not have any force or effect until the definition of "pension interest” in the Divorce Act is amended to include this.

It’s also interesting to note that section 37D(6) of the Pension Funds Act has been amended only to add the reference to "deferred pensioners”:

"(6) Despite paragraph (b) of the definition of "pension interest” in section 1 (1) of the Divorce Act, 1979 (Act 70 of 1979), the portion of the pension interest of a member or a deferred pensioner of a pension preservation fund or provident preservation fund, that is assigned to a non-member spouse, refers to the equivalent portion of the benefits to which that member would have been entitled in terms of the rules of the fund if his or her membership of the fund terminated, or the member or deferred pensioner retired on the date on which the decree was granted.”

Section 7(7) of the Divorce Act provides that a 'pension interest' (as defined in section 1) will be deemed to be a part of the assets at divorce:

"7) a) In the determination of the patrimonial benefits to which the parties to any divorce action may be entitled, the pension interest of a party shall, subject to paragraphs (b) and (c), be deemed to be part of his assets”

The wording of section 7(7) makes it clear that the non-member spouse is only permitted to a portion of the member spouse’s notional benefit if it qualifies as "pension interest” as defined.

"Pension interest” is defined in section 1 as referring to the benefits to which such member would have been entitled in terms of the rules of the fund if his membership of the fund would have been terminated on the date of the divorce on account of his resignation from his office, i.e. the member spouse must still hold a pension interest in the fund as at the date of divorce.

If a resignation benefit had already become payable to him before the divorce, he could not again be deemed to become entitled to a resignation benefit at the date of divorce. He would therefore no longer have a "pension interest” for the purposes of sections 7(7) and 7(8) of the Divorce Act read together with section 37D(4)(a) of the Pension Funds Act.

The Financial Services Law General Amendment Act has not made any amendments to the definition as quoted above and ccordingly, annuities purchased post-retirement remain excluded.

Conclusion

It might have been the intention of the legislature to close the "loophole” whereby someone can retire from a fund and purchase an annuity thereby effectively excluding it from the scope of section 7(7) and 7(8) of the Divorce Act. However, until the definition of "pension interest” in section 1 of the Divorce Act is accordingly amended, the changes will not affect annuities purchased upon retirement.

Divorce

Divorce

Divorce is a very real phenomenon in South Africa, but not a topic of discussion until it becomes a reality for a couple.

On average, women are the hardest hit financially by a divorce.

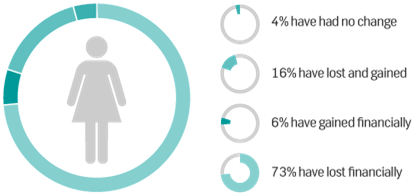

A poll* surveying women on how separation and divorce affected their financial welfare, revealed the following results:

Financial welfare of women after divorce

Financial welfare of women after divorce

Focusing on assets alone, women lose 77% of their wealth in the first year of divorce with 27 out of 100 women facing financial destitution; whereas a male's income increases by as much as 25% if he leaves a childless marriage. Women generally receive primary custody of children, but no longer enjoy the benefit of a two-income household after separation and divorce. However, the majority of expenses remain the same after the divorce, such as housing, food, education and transport. Depending on the divorce agreement, and the regularity of the payment of maintenance, this frequently falls short, and should not be considered as income. Legislation is helping to improve the non-payment of maintenance, but to enforce this legislation, women are absent from work as they seek legal assistance and court orders for payment of maintenance. More women are working, so the financial effects of divorce are less, but still remain. Poor decisions made before, during and after a divorce can impact a woman's financial health for the rest of her life.

Every woman, regardless of her perceived financial status, and who she is divorcing, should seek the advice of a divorce attorney, a financial adviser and a tax specialist if possible. A tax specialist can ensure that the structure of a divorce order will prevent unnecessary loss of funds to tax, in particular capital gains tax (CGT). While the financial adviser can provide options that will present the best possible investment vehicle for any retirement funds owing to the wife as part of a divorce order; the most suitable life insurance for both parties to protect the financial security of any children in the event of either spouse's death; and assist in the changing of wills and beneficiaries on any other policies. Divorce is a highly charged emotional process, but if a woman can step back and make the right decisions, a divorce need not dictate her financial future forever.

Preparing to get married under the Marriage Act

Preparing to get married under the Marriage Act

Download the digital brochure - The Legal Implications of Saying 'I Do' for more information.

If you wish to get married, you must:

• ensure that you are legally allowed to marry;

• understand the legal consequences of a marriage, particularly that marriages in South Africa are automatically in community of property, unless a valid antenuptial contract has been entered into before the marriage; and

• ensure sure that your marriage will comply with all the legal requirements for a valid marriage.

Confirm your marital status

Due to the large number of fraudulent and illegal marriages reported to the Department of Home Affairs each year, it is imperative for you to confirm your marital status at any time, on-line on the department’s website: http://www.dha.gov.za/marital_status.asp. You will need your South African ID number in order to use this facility.

You can also SMS the letter M followed by your ID number to 32551. A reply SMS will be sent back to your mobile phone to confirm your marital status and the date of your marriage, if applicable.

What documents do you need to supply?

On the day of the wedding, the couple must submit the following documents to the person officiating at the wedding:

identity documents (for each person getting married);

• if a foreign national is marrying a South African citizen, they must both present their valid passports, as well as a completed Declaration for the Purpose of Marriage, Letter of No Impediment;

• if the wedding is for a minor (a person under the age of 18 years), written consent of either both the parents/legal guardian or a Commissioner of Child Welfare OR the Minister of Home Affairs or a judge must be submitted. If the minors getting married are under the ages of 18 years for boys or 15 years for girls, written consent from the Minister of Home Affairs is also required;

• if any of the persons getting married are divorced, then the final decree of divorce must be furnished; and

• if any of the persons getting married are widowed, the deceased spouse’s death certificate must be submitted.

Useful Information

The legal implications of saying "I Do" - open the PFD and save the Brochure! The information provided is really useful, and easy to print for you to read through later!

Intro

Intro

The Matrimonial Property Act introduced ways to change the consequences that arose when a marriage was celebrated.

For example:

• Couples who married before or after the commencement of the Act can apply to court to change the applicable matrimonial property system;

• Either spouse whose conduct in administering the joint estate (in a marriage where joint administration operates) becomes intolerable, may have his or her powers of administration suspended by the court for a period.

Google Map

Contact Us

Physical Address:

9 Bird Street, Central, Port Elizabeth

Office land line:

+27 (0) 41 582 5150

Mobile: Please contact our offices

Email:

Emergency Contacts

EMERGENCY

Yokhuselo Haven:

041 581 4310 \ 0763127730

Email: office@yokhuselo.co.za

Web: www.yokhuselo.co.za

SAPS 10111

Family Violence, Child Abuse, Sexual Offence

012 393 2363

CRIME STOP 0860 010 111

Women Abuse 0800 150 150

Childline 0800 055 555

AIDS Helpline 0800 012 322 / 011 725 6710

Rape Crisis at Dora Nginza 041 995 1037

NMU Psychology Clinic 041 504 2330